MEL3E

Mathematics for Work and Everyday Life

Unit 4: Finding a Vehicle

Activity 6: Making Your Choice

There are more expenses involved in owning a vehicle besides putting gas in the tank and paying the insurance. If you don't consider these costs before buying your vehicle, these 'surpise' expenses can hurt you financially. However, in most cases, you can anticipate these extra costs and take them into account when you're budgeting for your new vehicle.

Consider: Other Vehicle Costs

Consider: Other Vehicle Costs

Based on your own experience, what are some of the other costs associated with owning and operating a vehicle?

Calculating Vehicle Costs

|

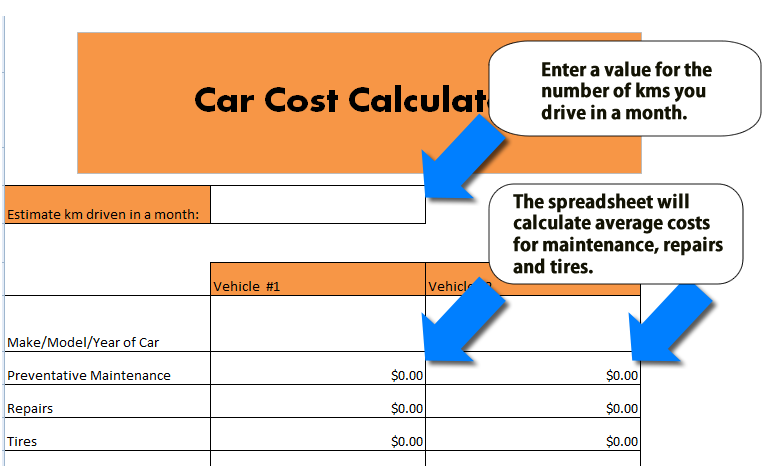

Now it's time to finish comparing the cost of operating the two vehicles you are considering buying. You will use this information to make a final decision about which car you're going to buy. You will use the Car Cost Calculator spreadsheet that you have been using in this unit to calculate the typical expenses for a vehicle (you can download a blank copy of the Car Cost Calculator spreadsheet). The Car Cost Calculator is broken down into two categories: Fixed Costs and Variable Costs. Variable Costs are costs that depend on how much you drive your car. Your insurance rate (from Activity 4) and fuel costs (from Activity 5) are examples of variable costs. Fixed Costs are expenses that are the same no matter how much you drive your car. Your financing costs (from Activity 3) is an example of a fixed cost. |

Variable Costs

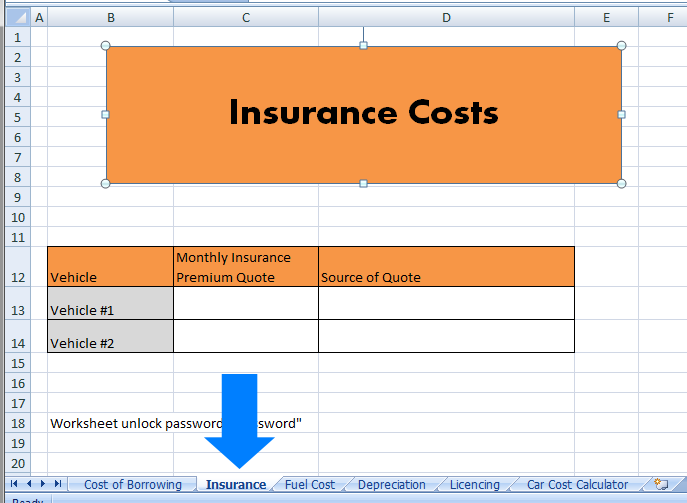

1. Insurance

Click on the insurance tab to enter your vehicle information.

|

In the previous activity, you estimated the monthly insurance payments for the two cars you're considering buying. If you haven't already done so, enter your insurance premiums in the Car Cost Calculator. |

Reflection

Reflection

Enter the monthly insurance premiums for the two cars in the Car Cost Calculator Spreadsheet.

2. Fuel Costs

|

In the previous activity, you estimated the monthly fuel costs for the two cars you're considering buying. If you haven't already done so, enter your fuel costs in the Car Cost Calculator. |

Reflection

Reflection

Enter the monthly fuel costs for the two cars in the Car Cost Calculator Spreadsheet.

3. Preventative Maintenance, Tires and Repairs

Maintaining your vehicle properly can prevent expensive repairs down the road. Replacing parts before they break, checking and replacing fluids and addressing problems before they get worse can save you thousands of dollars in repairs. Proper maintenance also makes your vehicle much safer to drive.

Some maintenance you can do yourself that won't cost you anything.

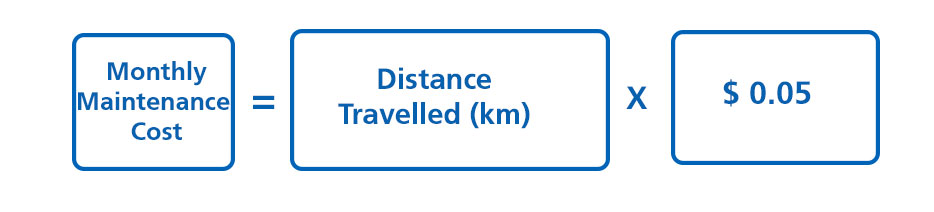

Average car maintenance costs are $0.05 per km (source: Canadian Automobile Association and Globe Drive research). To calculate your maintenance costs, use the number of kilometers you estimate that you drive in a month. Enter maintenance costs into your Car Cost Calculator.

You can use the same formula to calculate the average cost for tires ($0.014/km).

Repairs

Even if you maintain your vehicles carefully, eventually parts will wear out and need to be replaced. Although you can't predict repair costs, your monthly vehicle budget should include some money that you set aside for repairs. A recent Canadian report estimated the cost of repairs at 2 ¢ per kilometer driven.

Reflection

Reflection

|

By adding your estimated monthly driving in kilometers, the Car Cost Calculator spreadsheet will calculate your monthly costs for maintenance, tires and repairs. Before looking at the values in the spreadsheet, estimate on your own what those charges should be. Tire cost will be a little more than 1¢ per kilometer, repairs will be about 2¢ per kilometer and maintenance costs will be about 5¢ per kilometer. Example: If you drive 500 km per month, your tire cost would be around $5 (1¢ x 500), repairs $10 (2¢ x 500) and maintenance $25 (5¢ x 500). |

Fixed Costs

1. Cost of Borrowing

|

In the previous activity, you estimated the cost of borrowing for any new or used cars you're considering buying. Enter the cost of borrowing in the Car Cost Calculator. |

Reflection

Reflection

If you haven't already done so, enter the monthly interest payments for any new or used cars you're considering in the Car Cost Calculator Spreadsheet. If you're considering a lease, enter 0 for the cost of borrowing.

Think About It

Notice that the spreadsheet is only moving over the interest costs to the summary and not your full monthly car payment. Why do you think your full monthly payment isn't considered part of the cost of vehicle ownership?

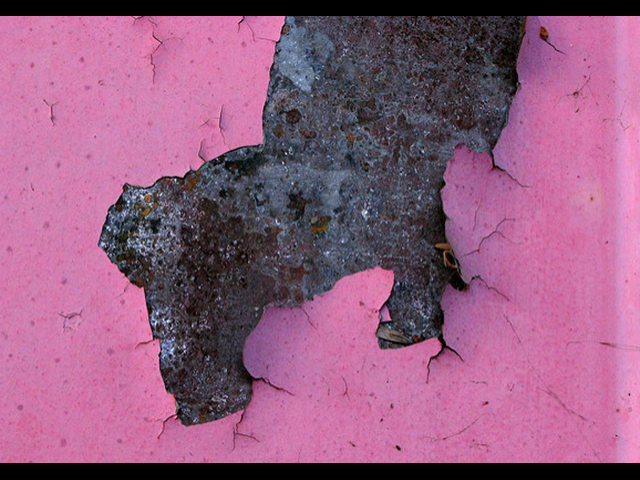

2. Depreciation

Photo Credit: Olivier Hill via Flickr

|

You can think of your vehicle as an investment. Except instead of going up in value, your vehicle decreases in value as you use it. You buy it for a certain price, and, as time goes by, the amount that you can sell it for decreases. The difference between what you paid for the vehicle and what you can sell it for is called depreciation. Depreciation is one of the most expensive costs of owning a vehicle but we often don't think about it. |

Use the Canada Black Book site or another site of your choosing to get the value of the two vehicles you're considering buying after three years of ownership.

Enter the value into the Depreciation tab in the Car Cost Calculator sheet.

Reflection

Reflection

Using the Canada Black Book site, this Car Depreciation Calculator site (or find another site by searching: Canada+blue+book+auto+value) get the value of any new or used cars that you're considering buying three years after ownership. Enter the values in the Car Cost Calculator and the spreadsheet will calculate the monthly depreciation cost.

Note that for leased vehicles there is no depreciation since you will not own the vehicle after the lease expires.

3. Lease

For leased vehicles, you don't have to worry about interest on loans or depreciation. However, when your lease expires, you don't own the vehicle. That means that the entire monthly lease payment is part of the cost of driving that vehicle.

Reflection

Reflection

Enter the monthly lease costs for any vehicles that you're considering leasing on the Summary page of the Car Cost Calculator. For vehicles that you're considering buying, leave this field blank.

4. License Renewal

|

An Ontario driver's license must be renewed every five years. You can find more information about license renewal at the Ministry of Transportation website. You can use the site to find out the procedure and fees associated with driver's license renewal. In addition, every year you need to get a new license plate sticker for each your vehicles. You can find information about the procedure and cost of license plate sticker renewals at this Ministry of Transportation website. |

Reflection

Reflection

Find the current license plate renewal fee for your area. Add it to the Plate Renewal Cost on the Car Cost Calculator spreadsheet.

Find the current driver's license renewal fee for Ontario. This fee must be paid every five years. Enter the full fee in the Car Cost Calculator Spreadsheet and the spreadsheet will calculate your cost per month.